Green financing: Advocates call for comprehensive loan products

Environmental advocates are engaging financial institutions to adopt favourable policies which will allow commercial banks to fund projects in the green financing ecosystem.

The head of green growth and development services at aBi Finance Noah Owomugisha says most commercial banks extend credit to particular projects which they find not to be risky.

He says commercial banks should stop discriminating as they extend loans, urging them to give out loans to people investing in climate change-related projects.

“We did a survey of 40 financial institutions leading in agribusiness and 30 of them had green loan products but which were not comprehensive so you find you find for example they cover solar but not biogas or when you come to borrow for manure, they say we don’t give money for manure go and borrow general agribusiness loan for manure. What we are saying is that for every technology you want to invest in as someone in value chain which is green, you should be able to have a comprehensive loan product when you go to your financial institution which will allow you to access such kind of financing,” Owomugisha said.

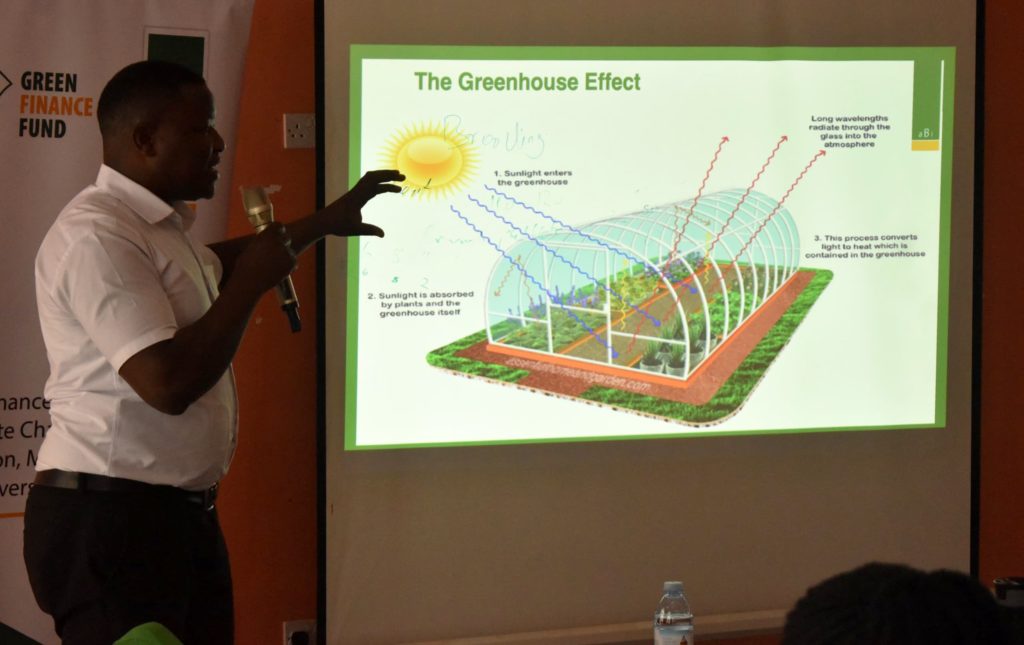

He made the remarks while sensitizing bankers on the green finance solutions in Kampala

Recently aBi Finance released Shs120 billion to fund green projects in the country during a sensitization campaign.

The funds are expected to strengthen the capacity of financial institutions to fund green projects in the country.