DFCU bank has taken over all the deposits of Global Trust bank in full.

This is after the Central Bank announced its closure over various inefficiencies including accumulation of loses of upto sh60bn since its establishment.

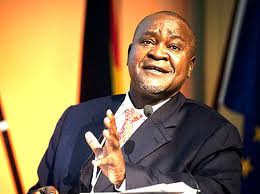

Addressing journalists this afternoon central Bank Governor Tumusiime Mutebile said depositors will start accessing their deposits and accounts from any DFCU branch from the first working day of next week.

Meanwhile, the borrowers will continue to service their loan obligations with DFCU bank and all employment contracts of all GTB staff are to be terminated.

The closure of this bank comes two months after leading banks reported significant losses or drop in profits owing to the ripple effects of the economic slow-down.

Global Trust bank was one of the six others that recorded losses in what turned out to be a tumultuous year for financial institutions.

In the 1990s and early 2000s, Uganda’s banking industry suffered a number of bank failures. Eight banks failed, forcing the Bank of Uganda to intervene and resolve them. In some cases the failed banks were closed, in others they were sold to new owners,” Kasekende said.

In recent years, National Bank of Commerce was closed, Uganda Commercial Bank was taken over by Stanbic bank. Nile Bank was bought by Barclays, while earlier on, Greenland and the Cooperative Bank were also closed, often amid public protest.