By Ssebuliba Samuel.

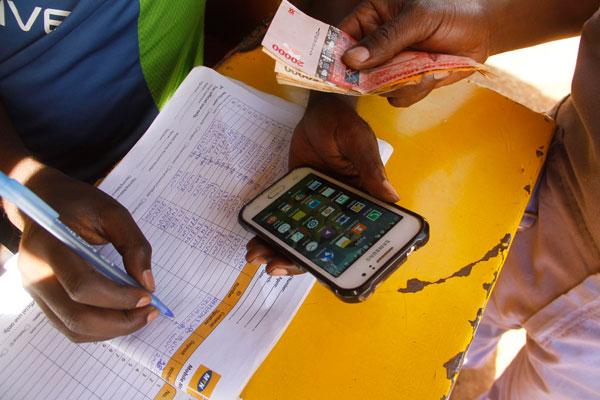

Parliament finally passed the excise duty amendment that was been tainted with the controversial 1% tax imposed on mobile money transaction and 200 shillings on social media.

The parliamentary report from finance committee this states that mobile money is an efficiency gain and should be taxed because money migrated from the traditional payment systems like banks to the digital platforms and thus such money must be taxed.

The report further indicates that using mobile money is a choice as there are other methods of payment which are already attracting taxes.

However the minister of state for finance David Bahati said that much as this tax will affect the poor, they need public goods like roads which can only be facilitated using taxes from such transactions as mobile money.

This has however attracted decanting views from members of parliament including the leader of opposition Winnie Kiiza and Cecilia Ogwal.

Other crucial area benefited from this bill is soft drinks where Excise duty have been reduced from the current 13% to 10 to avert smuggling of imported goods

The bill that was passed also saw parliament imposing 200 shilling tax on every liter of cooking oil, 100 shillings on every liter of fuel, 650 shillings on every liter of Kibuku, 200,000 shillings tax on every bodaboda registered while confectionaries were exempted from tax.